The Only Guide to Personal Loans copyright

The Only Guide to Personal Loans copyright

Blog Article

The Main Principles Of Personal Loans copyright

Table of ContentsSee This Report on Personal Loans copyrightThe smart Trick of Personal Loans copyright That Nobody is DiscussingPersonal Loans copyright Can Be Fun For EveryoneThe Basic Principles Of Personal Loans copyright About Personal Loans copyright

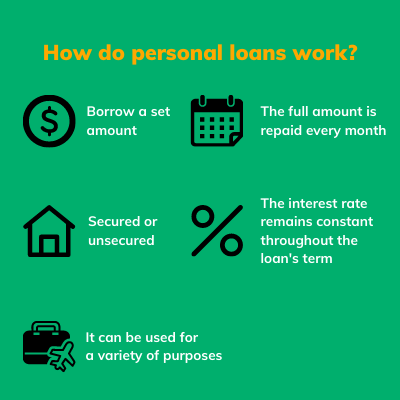

Settlement terms at the majority of personal funding lending institutions range in between one and seven years. You get all of the funds simultaneously and can use them for almost any type of objective. Consumers typically use them to fund a property, such as an automobile or a watercraft, pay off debt or assistance cover the cost of a major cost, like a wedding or a home improvement.

A fixed rate offers you the safety and security of a predictable regular monthly settlement, making it a popular selection for consolidating variable price credit cards. Repayment timelines vary for individual lendings, but consumers are usually able to pick repayment terms between one and seven years.

Our Personal Loans copyright PDFs

The cost is generally deducted from your funds when you settle your application, reducing the quantity of cash money you pocket. Individual car loans prices are more straight tied to short term rates like the prime rate.

You might be offered a reduced APR for a much shorter term, since lenders recognize your equilibrium will certainly be settled much faster. They may bill a higher rate for longer terms knowing the longer you have a finance, the much more likely something can transform in your funds that might make the payment unaffordable.

An individual finance is likewise an excellent option to utilizing bank card, since you borrow cash at a fixed rate with a certain reward day based on the term you pick. Maintain in mind: When the honeymoon mores than, the month-to-month repayments will certainly be a pointer of the cash you invested.

Facts About Personal Loans copyright Uncovered

Compare passion rates, charges and lending institution track record before using for the lending. Your credit history rating is a large aspect in establishing your eligibility for the loan as well as the interest price.

Before applying, recommended you read recognize what your score is to make sure that you recognize what to expect in terms of expenses. Watch for concealed charges and penalties by reviewing the lender's terms and problems web page so you don't wind up with much less money than you require for your economic objectives.

Personal lendings call for evidence you have the credit score account and income to settle them. Although they're much easier to get than home equity car loans or various other secured lendings, you still require to show the lending institution you have the methods to pay the loan back. Individual car loans are far better than credit report cards if you want an established month-to-month settlement and require every one of your funds at the same time.

Personal Loans copyright Can Be Fun For Anyone

Bank card might be much better if you need the flexibility to attract cash as required, pay it off and re-use it. Bank card might also offer benefits or cash-back choices that individual fundings don't. Eventually, the very best debt item for you will depend upon your money behaviors and what you need the funds for.

Some lenders may likewise bill fees for individual lendings. Individual lendings are lendings that can cover a number of individual expenses.

, there's commonly a fixed end day by which the finance will certainly be paid off. A personal line of credit scores, on the various other hand, may stay open and available to you indefinitely as lengthy as your account continues to be in excellent standing with your lending institution.

The cash gotten on the funding is not exhausted. Nonetheless, if the lender forgives the finance, it my review here is thought about a canceled debt, and that amount can be strained. Individual fundings might be secured or unsafe. A protected individual financing requires some kind of security as a condition of loaning. You may protect an individual you could try this out finance with cash properties, such as a cost savings account or certification of deposit (CD), or with a physical property, such as your cars and truck or boat.

The Best Strategy To Use For Personal Loans copyright

An unsafe personal car loan requires no security to obtain money. Banks, credit scores unions, and online loan providers can offer both protected and unsecured individual finances to qualified debtors.

Once more, this can be a financial institution, credit scores union, or on-line individual loan lender. If approved, you'll be offered the loan terms, which you can approve or decline.

Report this page